Director’s Column – from the Tennessee Concrete Magazine

Director’s Column

We are rapidly closing in on the end of the first quarter of 2025, and looking ahead to the rest of the year. The consensus of many in the construction industry at the end of 2024 was that 2025 was going to be a stronger year for construction with interest rates continuing to decline and a new administration coming in at the federal level.

That optimism has dimmed somewhat over the first quarter of 2025 as tariffs loom on the horizon, and as interest rate reductions keep getting pushed further into the future. At a minimum it is much more difficult to discern how the year will play out in terms of new projects as many people take more of a wait and see attitude about the whole economy. Longer-term, the construction industry is mostly optimistic about an increase in the construction economy as companies devote attention to re-shoring all kinds of manufacturing that will require a substantial amount of new construction at some point in the future.

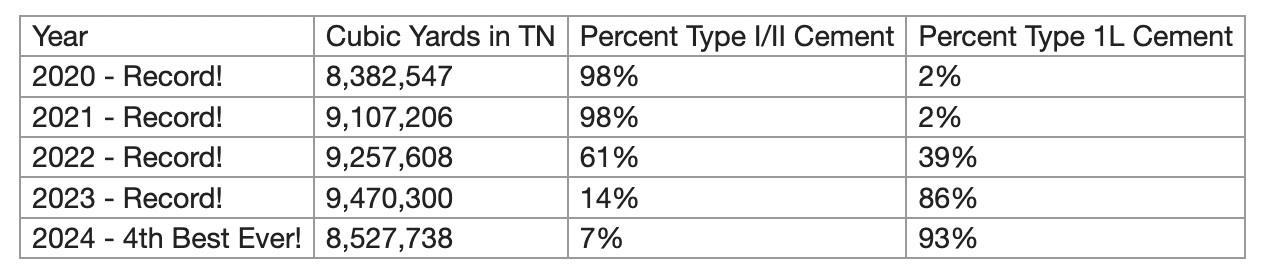

Recapping 2024 in terms of concrete production we see that our production dropped by about 10% as compared to 2023 and that ended four record years of concrete production in Tennessee. BUT - 2024 was still the fourth best year ever for concrete production for Tennessee and in fact was about 1.7% higher than our production in 2020. 2020 was the first year Tennessee’s production got back above 8 million cubic yards since 2007 and 2020 started our string of four record production years.

National concrete production peaked in 2005 at about 458 million cubic yards, dropping to about 414 million yards in 2007 to a low of about 260 million yards in 2010. Production remained below the 400 million yard mark until 2022 when we produced slightly over 401 million yards. National production was essentially flat in 2023, staying just above the 400 million yard mark, and then dropping about 5.5% to end 2024 at over 377 million yards.

The chart below recaps the last five years of concrete production in Tennessee, along with a nearly complete shift to Type 1L cement over that same period of time.

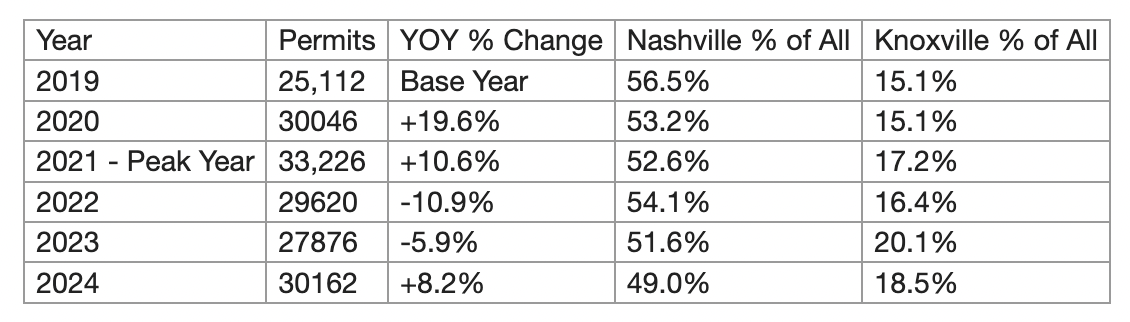

Another important metric we can track that is closely related to concrete production is housing starts. Nationally, residential construction consistently accounts for about 1/3 of total annual concrete production but the ripple effects of residential construction make it a good barometer for total concrete production. The table below tracks housing permits for residential construction (courtesy of Market Graphics). The other three markets tracked in this date include Memphis, Chattanooga and Clarksville with Memphis and Chattanooga typically each accounting for about 12% of annual starts and Clarksville for around 8% of the annual total.

Stay tuned for more information as 2025 proceeds!